Want to find the best Telegram bot list? We’ve got you covered. In this article, we’ll share how to use Bots on Telegram, how to create your own Telegram Bot and a list of the best Telegram Bots out there.

What is Telegram Bot List?

Introduced in 2015, Telegram Bots are third-party chat apps made with the Telegram Bot API. Telegram bots are essentially automated Telegram accounts you can chat with or add as friends to your chats, groups or channels.

While other messaging apps like WhatsApp and Kakao place strict limits on what users can create, Telegram allows their users to create Telegram Bots for pretty much anything. Today, you can easily create tons of useful Telegram bot list.

Users can create bots that act to play music, send emails, organize tasks, schedule reminders, or even as a digital storefront. There are plenty of bots out there to fulfil almost every need you can think of. One common question is, are Telegram Bots safe?

Are Telegram Bots safe?

While Telegram is known for its end-to-end encryption using MTProto, researchers found that Telegram Bots rely on a less secure protocol called Transport Layer Security. Adding a Telegram Bot weakens the encryption, making it more susceptible to hackers.

However, Telegram has refuted claims over its security issue stating that it’s another instance of If I had your keys, I could get into your home story. Considering both sides of the argument, are Telegram Bots truly safe? It’s best to use them at your own discretion.

Telegram Bot List: How to Use Bots on Telegram

While creating Telegram Bots require some coding skills, using a Telegram Bot is simple enough and anybody can do it. Simply follow the steps below to start using your first Telegram Bot.

1. Find the bot’s username using the in-app search bar and select the bot from the list.

Take note that you should be searching the Telegram bot’s username and not its display name. There can be multiple accounts with similar display names, but usernames cannot be duplicated.

2. Start a conversation with the Bot and follow the commands.

And you’re done! That’s pretty much it, although different bots have their own unique prompts and commands. If you’d like to have an idea of how these Telegram Bots work, don’t hesitate to check out our list of Telegram bots below.

5 Best Telegram Bot List

It’s hard to define what best Telegram Bots mean. It really depends on the kind of functionality you are looking for. To create our best Telegram Bot list we picked out the best bots for Telegram with functionality that goes above and beyond most bots.

1. Trello Bot (@trello_bot)

Trello is a kanban board for task and project management. If you get tired of using the interface to manage your project, try the Trello Bot. Using the Telegram Trello Bot enables you to create cards and receive update notifications from your Trello board.

Before using the Trello Bot, you will need to let the bot know which board you would like to connect to. Once connected you can add the bot to groups, create new Trello cards, and receive card notifications as well as user replies.

2. Gmail Bot (@gmailbot)

Want to use Gmail without leaving Telegram? Look no further, this is where the official Gmail Bot comes in. With the Gmail Bot, you can receive, send, and reply to emails within Telegram as instant messages.

To start using Gmail Bot, simply search for @gmailbot in the search bar and click Start to chat. Follow the commands on the screen and authorize your account. After authorization, you’ll start receiving emails in your Telegram chat.

3. Spotify Bot (@spotify_to_mp3_bot)

Didn’t think there were music bots on Telegram? Think Again. With Spotify Bot you’ll never have to leave Telegram to play music. Linking your Spotify account to Spotify Bot allows you to search, listen to and download tracks from Spotify’s database.

Once you’re connected, there’s a menu list for you to choose from. To start listening to your favorite tracks on Telegram, download a playlist or album.

4. ManyBot (@manybot)

Creating a Telegram bot from scratch may seem like a daunting task to many, but now there’s ManyBot to fix that. With ManyBot, you can create bots in Telegram without coding, such as broadcast messages, create custom commands and menus, auto post from RSS, Twitter or Youtube and add more admins to help you manage your groups.

To start, follow the command on ManyBot by going to BotFather for a new bot name and an API token. Then, link your API token back to ManyBot and give it a short description. Now, follow the rest of the instructions on ManyBot and you’re done!

While Telegram Bots can schedule and broadcast messages, bot owners will notice there’s nowhere to answer 1:1 messages sent to the bot. To do so, you can create a respond.io account and connect your Telegram Bot List to the platform.

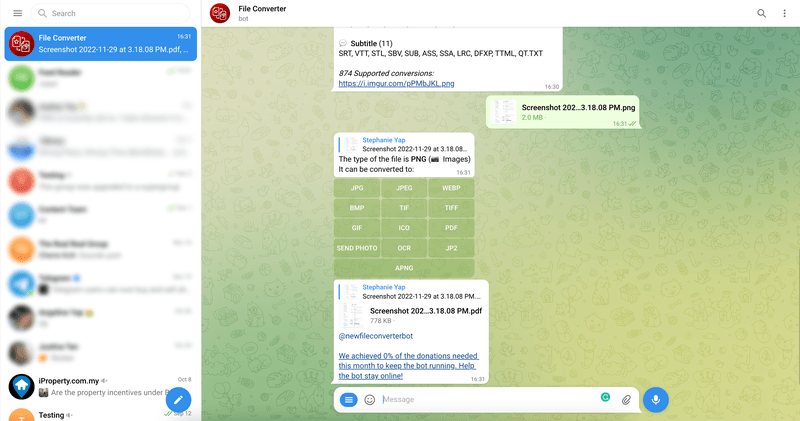

5. File Converter (@newfileconverterbot)

Want to convert files or images from one format to another? Now you can do it easily with the File Converter bot. Just search for the name in the search bar and click start.

To convert a file or an image, just send it to the bot. It will provide a list of formats that you can convert to. Pick the format that you want and finally, click on the name of the file to download the converted file.

6. DropMail.me (@DropMailBot)

For those who don’t want to share their email address in contact forms to avoid receiving spam mail, DropMail has a solution for you. This bot provides temporary email addresses and receives confirmation or activation emails to complete your sign-up process.

Once you’ve connected DropMail.me. to your Telegram account, click start and you’ll receive a list of action prompts. To generate a new temporary email address, type /get.

7. Zoom (@zoombot)

Don’t want to install the Zoom app on your phone or computer? No worries. Just connect the Zoom bot with your Telegram app. Here, you can create or join a meeting straight from Telegram.

To get started, sign in to your existing Zoom account on the website or create a new one if you don’t have an account. Now you can create a new meeting or join one by clicking the three horizontal lines in the bottom left page of the chat.

8. File to Bot (@filetobot)

For those who worry about running out of storage on their phones or computers, consider adding File to Bot to your Telegram. It acts as an external cloud for your files. Here, you can organize your saved images, documents, files and more.

Just send your files to the bot and it will store them in the cloud. Uploaded files can be downloaded easily from the bot too! And the best thing is, there is no limitation on file size so you can upload as many as you want to.

9. Babelgram (@BabelgramBot)

Are you chatting with a customer who speaks another language? Save the hassle of copying and pasting the message and use Babelgram to help you to translate right while you’re typing.

First, you need to add Babelgram to your chat. Whenever you want to converse in another language, tag @BabelgramBot, followed by the code for the original language and the code for the translated language into the chat. Then, click on the translated text to send the message.

10. Dr. Web (@drwebbot)

There’s nothing scarier than receiving a file that contains viruses that could corrupt your devices. To ensure the safety of files and links transferred via Telegram, get a consultation from Dr. Web. It’s the first anti-virus bot for checking links and files and it works on any device that has Telegram installed on it.

To check whether a file is safe to open, just forward it to Dr. Web. The bot will scan it and let you know if there’s any threat detected.

11. IFTTT Bot (@IFTTT)

IFTTT, also known as If This Then That is a software platform that connects and syncs your favorite apps and devices using chains of conditional statements. The IFTTT Bot links Telegram to 360 other services, enabling you to use it in groups, channels or as a personal assistant in various ways.

For the more adventurous, signing up with IFTTT also allows you to create and customize your own chain of conditional statements or applets. While uploading applets on IFTTT is a paid service, using the platform and integrating it with Telegram is free.

Now that you know where to find the best Telegram bot list, it’s time to add them to your Telegram. Connect your Telegram to respond.io today.

Further Reading

We’ll continue updating our Telegram bot list with new top Telegram Bots in the future. In the meantime, check out the other articles on Telegram.